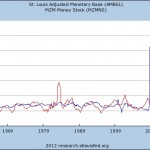

I undertake money supply analysis through examination of total commercial bank liabilities in domestic currency. The rate of commercial bank lending explains the business cycle better than traditional measures of the money supply. Further analysis, conducted into the composition of bank liabilities, reveals the predominance of business lending over other types of lending up to [...]