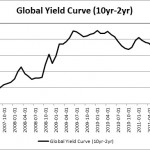

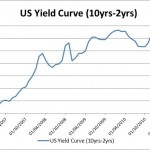

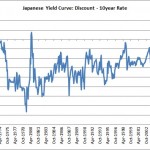

The Japanese yield curve reveals the true state of Japanese monetary policy over the last 20 years. Has it really been ultra loose as suggested by the low short-term rate or more moderate? Examination of the Japanese yield curve also has implications for the West. Is the West following the same policies as Japan and [...]